22574 जब कांग्रेस के नेता चिदंबरम ने भारत के ही खिलाफ लड़ा था केस 77 views. DICGC Act: Notices: Core Principles of IADI: For Depositors. For Liquidators. Deposit Insurance and Credit Guarantee Corporation, Reserve Bank of. The Deposit Insurance Corporation (DIC) Bill was introduced in the Parliament on August 21, 1961. After it was passed by the Parliament, the Bill got the assent of the President on December 7, 1961 and the Deposit Insurance Act, 1961 came into force on January 1, 1962. (1) This Act may be called the Deposit Insurance and Credit Guarantee Corporation Act, 1961. (2) It extends to the whole of India. (3) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint. In this Act, unless the context otherwise requires.

Deposit Insurance and Credit Guarantee Corporation Act is for the establishment of a corporation for insurance of deposits and guaranteeing of credit facilities.

Deposit Insurance and Credit Guarantee Corporation Act, 1961

The aim of the DICGC Act, 1961 is to provide for the establishment of a corporation for the purpose of insurance of deposits and guaranteeing of credit facilities and various other matters which.

[Act 47 of 1961] [7th December, 1961]

An Act to provide for the establishment of a corporation for the purpose of insurance of deposits[i][and guaranteeing of credit facilities] and for other matters connected therewith or incidental thereto

Be it enacted by Parliament in the Twelfth Year of the Republic of India as follows:—

Chapter I

PRELIMINARY

1. Short title, extent and commencement.

1. Short title, extent and commencement.—(1) This Act may be called [ii][the Deposit Insurance and Credit Guarantee Corporation] Act, 1961.

(2) It extends to the whole of India.

(3) It shall come into force on such date[iii] as the Central Government may, by notification in the Official Gazette, appoint.

| Index of Deposit Insurance and Credit Guarantee Corporation Act, 1961 |

|---|

| Sections 1 to 9 |

| Sections 10 to 21-B |

| Sections 22 till End |

2. Definitions.

2. Definitions.—In this Act, unless the context otherwise requires,—

(a) “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft, order or otherwise;

(b) “banking company” means any company which transacts the business of banking in India and includes the State Bank [iv][and a subsidiary bank] but does not include the [v][Tamil Nadu Industrial Investment Corporation Limited].

Explanation.—Any company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business as such manufacturer or trader shall not be deemed to transact the business of banking within the meaning of this clause;

(c) “Board” means the Board of directors constituted under Section 6;

(d) “company” means any company as defined in Section 3 of the Companies Act, 1956 (1 of 1956), and includes a foreign company within the meaning of Section 591 of that Act;

[vi][(dd) “co-operative bank” means a State co-operative bank, a Central co-operative bank and a Primary co-operative bank;]

(e) “Corporation” means [vii][the Deposit Insurance and Credit Guarantee Corporation] established under Section 3;

[viii][(ee) “corresponding new bank” means a corresponding new bank constituted under Section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (5 of 1970) or, as the case may be, under Section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 (40 of 1980);]

[ix][(eea) “credit institution” means all or any of the following, namely:—

(i) a banking company;

(ii) a corresponding new bank;

(iii) a Regional Rural Bank;

(iv) a co-operative bank;

(v) a financial institution;]

(f) “defunct banking company” means a banking company—

(i) which has been prohibited from receiving fresh deposits; or

(ii) which has been ordered to be wound up; or

(iii) which has transferred all its deposit liabilities in India to any other institution; or

(iv) which has ceased to be a banking company within the meaning of sub-section (2) of Section 36-A of [x][the Banking Regulation Act, 1949 (10 of 1949)] or has converted itself into a non-banking company; or

(v) in respect of which a liquidator has been appointed in pursuance of a resolution for the voluntary winding up of its affairs; or

(vi) in respect of which any scheme of compromise or arrangement or of reconstruction has been sanctioned by any competent authority and the said scheme does not permit the acceptance of fresh deposits; or

(vii) which has been granted a moratorium which is in operation; or

(viii) in respect of which an application for the winding up of its affairs is pending in a competent court;

[xi][(ff) “defunct co-operative bank” means a co-operative bank—

(i) which has been prohibited from receiving fresh deposits; or

(ii) which has been ordered or directed to be wound up; or

(iii) which has transferred all its deposit liabilities in India to any other institution; or

(iv) which has ceased to be a co-operative bank within the meaning of sub-section (2) of Section 36-A of the Banking Regulation Act, 1949 (10 of 1949); or

(v) which has converted itself into a non-banking co-operative society; or

(vi) in respect of which any scheme of compromise or arrangement or of reconstruction has been sanctioned under any law for the time being in force and such scheme does not permit the acceptance of fresh deposits; or

(vii) which has been granted a moratorium which is in operation; or

(viii) in respect of which an application for winding up is pending before the Registrar of co-operative societies or other competent authority under any law relating to co-operative societies for the time being in force in a State;]

(g) “deposit” means the aggregate of the unpaid balances due to a depositor (other than a foreign Government, the Central Government, a State Government, [xii][a corresponding new bank [xiii][or [a Regional Rural Bank or a banking company] or a Co-operative bank]]) in respect of all his accounts, by whatever name called, [xiv][with a corresponding new bank or [xv][with a Regional Rural Bank or with a banking company] or a co-operative bank] and includes credit balances in any cash credit account but does not include,—

(i) [xvi][Where a banking company [xvii][or a Regional Rural Bank] or a corresponding new bank] at the commencement of this Act [xviii][or where an eligible co-operative bank at the commencement of the Deposit Insurance Corporation (Amendment) Act, 1968 (56 of 1968)] is working under a scheme of compromise or arrangement or of reconstruction sanctioned by any competent authority providing for the acceptance of fresh deposits, any amount due to the depositor in respect of his deposit before the date of the coming into force of the scheme to the extent it is not credited after the said date under the provisions of that scheme; or

Dicgc Act India

[xix][(i-a) any amount due on account of any deposit with any insured bank which has been specially executed in this behalf by the Corporation with the previous approval of the Reserve Bank; or]

(ii) any amount due on account of any deposit received outside India;

[xx][(gg) “eligible co-operative bank” means a co-operative bank the law for the time being governing which provides that—

(i) an order for the winding up, or an order sanctioning a scheme of compromise or arrangement or of amalgamation or reconstruction, of the bank may be made only with the previous sanction in writing of the Reserve Bank;

(ii) an order for the winding up of the bank shall be made if so required by the Reserve Bank in the circumstances referred to in Section 13-D;

(iii) if so required by the Reserve Bank in the public interest or for preventing the affairs of the bank being conducted in a manner detrimental to the interests of the depositors or for securing the proper management of the bank, an order shall be made for the supersession of the committee of management or other managing body (by whatever name called) of the bank and the appointment of an administrator therefor for such period or periods not exceeding five years in the aggregate as may from time to time be specified by the Reserve Bank;

(iv) an order for the winding up of the bank or an order sanctioning a scheme of compromise or arrangement or of amalgamation or reconstruction or an order for the supersession of the committee of management or other managing body (by whatever name called) of the bank and the appointment of an administrator therefor made with the previous sanction in writing or on the requisition of the Reserve Bank shall not be liable to be called in question in any manner; and

(v) the liquidator or the insured bank or the transferee bank, as the case may be, shall be, under an obligation to repay the Corporation in the circumstances, to the extent and in the manner referred to in Section 21;]

(h) “existing banking company” means a banking company carrying on the business of banking at the commencement of this Act which either holds a licence at such commencement under Section 22 of the Banking Regulation Act, 1949 (10 of 1949) or having applied for such licence has not been informed by notice in writing by the Reserve Bank that a licence cannot be granted to it and includes the State Bank and a subsidiary bank, but does not include a defunct banking company;

[xxi][(hh) “existing co-operative bank” means a co-operative bank carrying on the business of banking at the commencement of the Deposit Insurance Corporation (Amendment) Act, 1968 (56 of 1968), which either holds a licence at such commencement under Section 22 of the Banking Regulation Act, 1949 (10 of 1949), or having applied for such licence has not been informed by notice in writing by the Reserve Bank that a licence cannot be granted to it but does not include a defunct co-operative bank;]

[xxii][(hh-a) “financial institution” means any financial institution within the meaning of clause (c) of Section 45-I of the Reserve Bank of India Act, 1934 (2 of 1934);]

[xxiii][(i) “insured bank” means a [xxiv][a Banking company] [xxv][or a corresponding new bank] [xxvi][or a Regional Rural Bank] or an eligible co-operative bank for the time being registered under the provisions of this Act and includes for the purposes of Sections 16, 17, 18 and 21,—]

[xxvii][(i) a banking company referred to in clause (a) or clause (b) of sub-section (1) of Section 13, or

(i-a) a corresponding new bank to which the provisions of clause (a) of sub-section (1) of Section 13 apply, or]

(ii) a co-operative bank referred to in clause (a) or clause (b) of Section 13-C, the registration whereof has been cancelled under Section 13, or as the case may be, under Section 13-C;]

(j) “insured deposit” means the deposit or any portion thereof the repayment whereof is insured by the Corporation under the provisions of this Act;

(k) “new banking company” means a banking company which begins to transact the business of banking after the commencement of this Act under a licence granted to it under Section 22 of [xxviii][the Banking Regulation Act, 1949 (10 of 1949)] [xxix][***];

[xxx][(kk) “new co-operative bank” means a co-operative bank which begins to transact the business of banking after the commencement of the Deposit Insurance Corporation (Amendment) Act, 1968 (56 of 1968), under a licence granted to it under Section 22 of the Banking Regulation Act, 1949 (10 of 1949), and includes a primary credit society becoming a primary co-operative bank after such commencement;]

(l) “premium” means the sum payable by an insured bank under Section 15 of this Act;

(m) “prescribed” means prescribed by regulations made under this Act;

[xxxi][(m-a) “Regional Rural Bank” means a Regional Rural Bank established under Section 3 of the Regional Rural Banks Act, 1976 (20 of 1976);]

(n) “Reserve Bank” means the Reserve Bank of India constituted under the Reserve Bank of India Act, 1934 (2 of 1934);

(o) “State Bank” means the State Bank of India constituted under the State Bank of India Act, 1955 (23 of 1955);

(p) “subsidiary bank” shall have the meaning assigned to it in Section 2 of the State Bank of India (Subsidiary Banks) Act, 1959 (38 of 1959);

[xxxii][(q) the expressions “central co-operative bank”, [xxxiii][* * *] and “State co-operative bank” shall have the meanings respectively assigned to them in the National Bank for Agriculture and Rural Development Act, 1981;

(r) the expressions [xxxiv][“co-operative society”] “primary co-operative bank” and “primary credit society” shall have the meanings respectively assigned to them in Part V of the Banking Regulation Act, 1949 (10 of 1949).]

Chapter II

ESTABLISHMENT AND MANAGEMENT OF THE DEPOSIT INSURANCE CORPORATION

3. Establishment and incorporation of Deposit Insurance Corporation.

3. Establishment and incorporation of Deposit Insurance Corporation.— (1) The Central Government shall, by notification in the Official Gazette, establish a Corporation by the name of the Deposit Insurance Corporation which shall be a body corporate having perpetual succession and a common seal with power, subject to the provisions of this Act, to acquire, hold or dispose of property and to contract, and may, by the said name, sue or be sued.

[xxxv][(1-A) Any reference in this Act to the Deposit Insurance Corporation shall, on and from the date on which Chapter II of the Deposit Insurance Corporation (Amendment and Miscellaneous Provisions) Act, 1978, comes into force, be construed as a reference to the Deposit Insurance and Credit Guarantee Corporation.]

(2) The head office of the Corporation shall be at Bombay, but it may, with the previous sanction of the Reserve Bank, establish branches or agencies in any other place in India.

4. Capital of Corporation.

[xxxvi][4. Capital of Corporation.—(1) The authorised capital of the Corporation shall be one crore of rupees but the Central Government may, in consultation with the Reserve Bank, increase such capital from time to time, so, however, that the total authorised capital shall not exceed [xxxvii][fifty crores of rupees].

(2) The [xxxviii][issued capital] for the time being of the Corporation shall be fully paid-up and shall stand allotted to the Reserve Bank.]

5. Management of Corporation.

5. Management of Corporation.—The general superintendence, direction and the management of the affairs and business of the Corporation shall vest in a Board of directors which may exercise all powers and do all acts and things which may be exercised or done by the Corporation.

6. Board of directors.

6. Board of directors.—(1) The Board of directors of the Corporation shall consist of the following, namely:—

[xxxix][(a) the Governor, for the time being, of the Reserve Bank or, if the Reserve Bank, in pursuance of the decision of the Committee of the Central Board of Directors of that Bank, nominates any Deputy Governor for the purpose, the Deputy Governor so nominated, who shall be the Chairman of the Board;]

(b) [xl][a Deputy Governor or any other officer] of the Reserve Bank nominated by that bank;

(c) an officer of the Central Government nominated by that Government;

[xli][(d) five directors nominated by the Central Government in consultation with the Reserve Bank, three of whom shall be persons having special knowledge of commercial banking, insurance, commerce, industry or finance and two of whom shall be persons having special knowledge of, or experience in, co-operative banking or co-operative movement, and none of the directors shall be an officer of Government or of the Reserve Bank or an officer or other employee of the Corporation or a director, an officer or other employee of a banking company or a co-operative bank or otherwise actively connected with a banking company or a co-operative bank;]

[xlii][(e) four directors, nominated by the Central Government in consultation with the Reserve Bank, having special knowledge or practical experience in respect of accountancy, agriculture and rural economy, banking, co-operation, economics, finance, law or small-scale industry or any other matter, the special knowledge of, and practical experience in which, is likely, in the opinion of the Central Government, to be useful to the Corporation.]

[xliii][(2) (i) A director nominated under clause (b) or clause (c) [or clause (d) or clause (e)][xliv] of sub-section (1) shall hold office during the pleasure of the authority nominating him; and]

[xlv][(ii) Subject to the provisions contained in clause (i), a director nominated under clause (d) or clause (e) of sub-section (1), shall hold office for such period, not exceeding three years, as may be specified by the Central Government in this behalf and thereafter until his successor assumes office, and shall be eligible for re-nomination:

Provided that no such director shall hold office continuously for a period exceeding six years;]

(3) A person shall not be capable of being nominated as a director under clause (d) [xlvi][or clause (e)] of sub-section (1) if—

(a) he has been removed or dismissed from the service of Government or of a local authority or of a corporation or company in which not less than fifty-one per cent of the paid-up share capital is held by Government; or

(b) he is or at any time has been adjudicated as insolvent or has suspended payment of his debts or has compounded with his creditors; or

(c) he is of unsound mind and stands so declared by a competent court; or

(d) he has been convicted of any offence which, in the opinion of the Central Government, involves moral turpitude.

(4) If a director nominated under clause (d) of sub-section (1),—

(a) becomes subject to any of the disqualifications mentioned in clauses (a) to (d) of sub-section (3); or

(b) is absent without leave of the Board for more than three consecutive meetings thereof; or

(c) becomes a director or an officer or an employee of an insured bank or is, in the opinion of the Central Government, otherwise actively connected with such bank; or

(d) becomes an officer or other employee of Government or of the Reserve Bank or of the Corporation;

his seat shall thereupon become vacant.

[xlvii][(5) If a director nominated under clause (e) of sub-section (1)—

(a) becomes subject to any of the disqualifications mentioned in clauses (a) to (d) of sub-section (3); or

(b) is absent without leave of the Board for more than three consecutive meetings thereof,

his seat shall thereupon become vacant.]

7. Meetings of Board.

7. Meetings of Board.—(1) The Board shall meet at such times and places and shall observe such rules of procedure in regard to the transaction of business at its meetings as may be prescribed.

(2) The Chairman or, if for any reason he is unable to attend, the director nominated under clause (b) of sub-section (1) of Section 6 shall preside at meetings of the Board and, in the event of equality of votes, shall have a second or casting vote.

8. Committees of Corporation.

8. Committees of Corporation.—(1) The Board may constitute an Executive Committee consisting of such number of directors as may be prescribed.

(2) The Executive Committee shall discharge such functions as may be prescribed or may be delegated to it by the Board.

(3) The Board may constitute such other committees, whether consisting wholly of directors or wholly of other persons or partly of directors and partly of other persons as it thinks fit for the purpose of discharging such of its functions as may be prescribed or may be delegated to them by the Board.

(4) A committee constituted under this section shall meet at such times and places and shall observe such rules of procedure in regard to the transaction of business at its meetings as may be prescribed.

(5) The members of a committee (other than directors of the Board) shall be paid by the Corporation such fees and allowances for attending its meetings and for attending to any other work of the Corporation as may be prescribed.

9. Fees and allowances of directors.

9. Fees and allowances of directors.—The directors of the Board shall be paid by the Corporation such fees and allowances for attending the meetings of the Board or of any of its committees and for attending to any other work of the Corporation as may be prescribed:

Provided that no fees shall be payable to the Chairman or to the director nominated under clause (b) or clause (c) of sub-section (1) of Section 6.

[ii]Substituted by Act 21 of 1978, S. 8(2).

[iii] This Act came into force w.e.f. 1st January, 1962.

[iv]Substituted by Act 1 of 1984, S. 56 (w.e.f. 15-2-1984).

[v]Substituted by Act 56 of 1974, S. 3 and Sch. II.

[vii]Substituted by Act 21 of 1978, S. 8.

[viii]Substituted by Act 1 of 1984, S. 56 (w.e.f. 15-2-1984).

[x]Substituted by Act 56 of 1968, S. 2, for “the Banking Companies Act, 1949”.

[xii]Substituted by Act 5 of 1970, S. 20.

[xiv]Substituted by Act 5 of 1970, S. 20 (w.e.f. 19-7-1969).

[xvi]Substituted by Act 5 of 1970, S. 20.

[xviii]Substituted by Act 56 of 1968, S. 3.

Dicgc Act In Marathi

[xx]Inserted by Act 56 of 1968, S. 3.

[xxii]Inserted by Act 21 of 1978, S. 8.

[xxiv]Substituted by Act 19 of 1988, S. 3 and Second Schedule.

[xxv]Inserted by Act 1 of 1984, S. 56 (w.e.f. 1-7-1971).

[xxvii]Substituted by Act 1 of 1984, S. 56 (w.e.f. 19-7-1969).

Dicgc Is A Subsidiary Of

[xxviii]Substituted by Act 56 of 1968, S. 2, for “the Banking Companies Act, 1949”.

[xxix]Omitted by Act 1 of 1984, S. 56 (w.e.f. 15-2-1984).

[xxxi]Inserted by Act 21 of 1976, S. 33.

[xxxii]Substituted by Act 61 of 1981, S. 61 and Second Schedule.

[xxxiii] The words “co-operative society” omitted by Act 24 of 2004, Section 3 (w.e.f. 1-3-1966).

[xxxiv]Inserted by Act 24 of 2004, Section 3 (w.e.f. 1-3-1966).

[xxxvi]Substituted by Act 56 of 1968, S. 4.

[xxxvii]Substituted by Act 1 of 1984, S. 57 (w.e.f. 15-2-1984).

[xxxix]Substituted by Act 21 of 1978, S. 8.

[xl]Substituted by Act 56 of 1968, S. 5, for the words “a Deputy Governor”.

[xlii]Inserted by Act 21 of 1978, S. 8.

[xliii]Substituted by Act 1 of 1984, S. 58 (w.e.f. 15-2-1984).

[xliv]Inserted by Act 66 of 1988, S. 24 (w.e.f. 30-12-1988).

[xlv]Substituted by Act 66 of 1988, S. 24 (w.e.f. 30-12-1988).

Dicgc Act In Hindi

[xlvi]Inserted by Act 1 of 1984, S. 58 (w.e.f. 15-2-1984).

Dicgc India

[xlvii]Inserted by Act 1 of 1984, S. 58 (w.e.f. 15-2-1984).

Dicgc Act

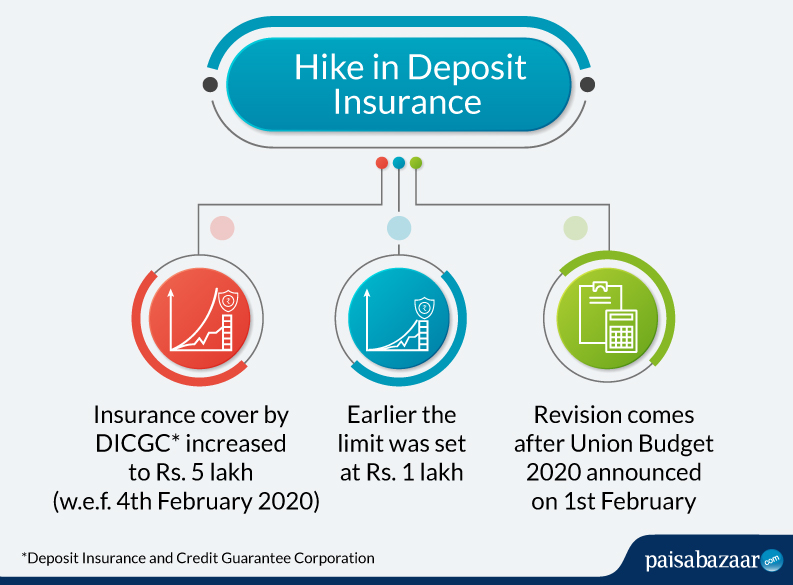

New Delhi, Feb 1 (PTI) The government on Monday proposed changes in the DICGC Act to ensure depositors of troubled banks can withdraw their funds of up to Rs 5 lakh.

In the light of lenders like Punjab and Maharashtra Co-operative (PMC) Bank, Yes Bank and Lakshmi Vilas Bank running into trouble in recent times, the government had amended the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, raising the insurance cover on deposit five-fold to Rs 5 lakh.

'I shall be moving amendments to the DICGC Act, 1961 in this Session itself to streamline the provisions, so that if a bank is temporarily unable to fulfil its obligations, the depositors of such a bank can get easy and time-bound access to their deposits to the extent of the deposit insurance cover,' Finance Minister Nirmala Sitharaman said in her Budget speech.

This would help depositors of banks that are currently under stress, she added.

DICGC, a wholly-owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

As per the current provisions, the deposit insurance of up to Rs 5 lakh comes into play when the licence of a bank is cancelled and liquidation process starts.

Meanwhile, the Reserve Bank of India (RBI) on Monday said it has cancelled the licence of Shivam Sahakari Bank, Ichalkaranji, Kolhapur, Maharashtra.

The Commissioner for Cooperation and Registrar of Cooperative Societies, Maharashtra has also been requested to issue an order for winding up the bank and appoint a liquidator for the lender, it said.

'With the cancellation of licence and commencement of liquidation proceedings, the process of paying the depositors of Shivam Sahakari Bank Ltd, Ichalkaranji, Kolhapur, Maharashtra as per the DICGC Act, 1961 will be set in motion,' RBI said.

The central bank also said that as per the data submitted by the bank, more than 99 per cent of the depositors are fully insured by DICGC.

On liquidation, every depositor would be entitled to receive deposit insurance claim amount of his/her deposits up to a monetary ceiling of Rs 5 lakh from the DICGC, subject to provisions, it added. PTI DP NKD DP ABM

ABM